Corp Delaware Gov

Division of Corporations - State of Delaware

Why Incorporate in Delaware? More than one million business entities take advantage of Delaware's complete package of incorporation services, including modern and flexible corporate laws, our highly-respected Judiciary and legal community, a business-friendly government, and the customer-service-oriented staff of the Division of Corporations. You can also stay current on Delaware Corporate Law ...

https://corp.delaware.gov/

Online Services - Division of Corporations - State of Delaware

The Division of Corporations provides services that allow you to pay your annual taxes and file corporate annual reports, file UCC 1 and UCC 3 documents online and view the Delaware General Corporate Law via the internet. You may now also reserve names, check status of an entity and corporate history online.

https://corp.delaware.gov/services/

Annual Report and Tax Instructions - Division of Corporations - Delaware

Foreign Corporations. Foreign Corporations must file an Annual Report with the Delaware Secretary of State on or before June 30 each year. A $125.00 filing fee is required to be paid. If the Annual Report and remittance is not received by the due date, a $125.00 penalty will be added to filing fee.

https://corp.delaware.gov/paytaxes/

Corporate Forms and Certificates - State of Delaware

Corporate Forms and Certificates. Listen. You may select your corporate forms by ENTITY TYPE, by DOCUMENT TYPE. or you may select UCC FORMS. All requests are returned regular USPS mail. Please provide an express mail account number with your order for Fed-X or UPS express service return.

https://corp.delaware.gov/corpforms/

Contact Information - Division of Corporations - State of Delaware

General Information – (302) 739-3073 option 2. Update regarding General Information: The Division of Corporations will no longer provide entity filing history over the telephone. More Info. Franchise Tax – (302) 739-3073 option 3. Uniform Commercial Code – (302) 739-3073 option 4. Service of Process – (302) 739-3073.

https://corp.delaware.gov/contact/

DIVISION OF CORPORATIONS - Delaware

More than 1.1 million business entities have their legal home in Delaware including more than 55% of all U.S. publicly-traded companies and 65% of the Fortune 500. Businesses choose Delaware because we provide a complete package of incorporation services including modern and flexible corporate laws, our highly-respected Court of Chancery, a ...

https://icis.corp.delaware.gov/

Accessing Corporate Information - Division of Corporations - Delaware

The Division of Corporations has many venues for accessing corporate information. You may choose from the following options: Corporate Status Online – (This application will reflect the status of an entity but will not generate an official certificate of good standing) You may check corporate/entity status on the web for a fee of $10.00 per entity for status or $20.00 per entity for more ...

https://corp.delaware.gov/directweb/

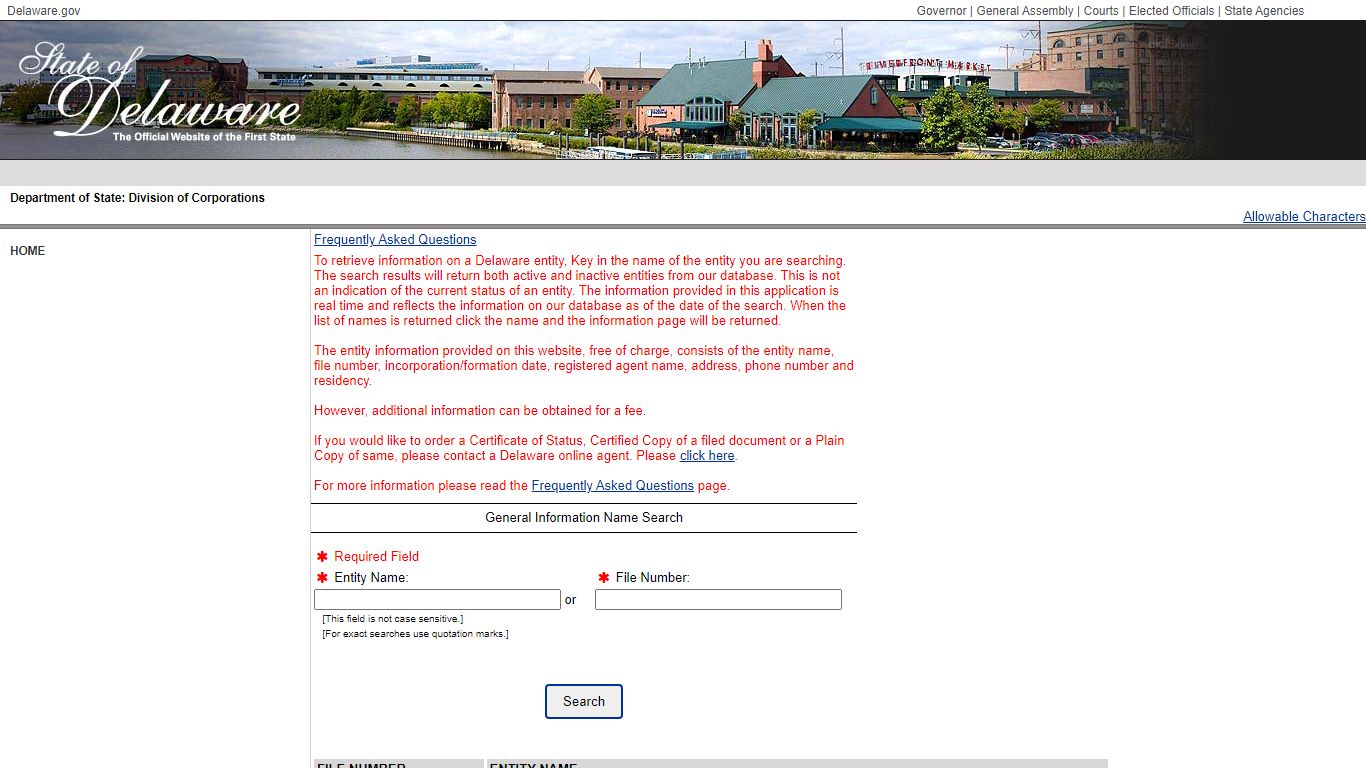

Division of Corporations - Filing - Delaware

When the list of names is returned click the name and the information page will be returned. The entity information provided on this website, free of charge, consists of the entity name, file number, incorporation/formation date, registered agent name, address, phone number and residency. However, additional information can be obtained for a fee.

https://icis.corp.delaware.gov/Ecorp/EntitySearch/NameSearch.aspx

Delaware.gov - Official Website of the State of Delaware

The official website of the State of Delaware. Find information about state government, programs, and services. The First State is located in the Northeast U.S.

http://delaware.gov/

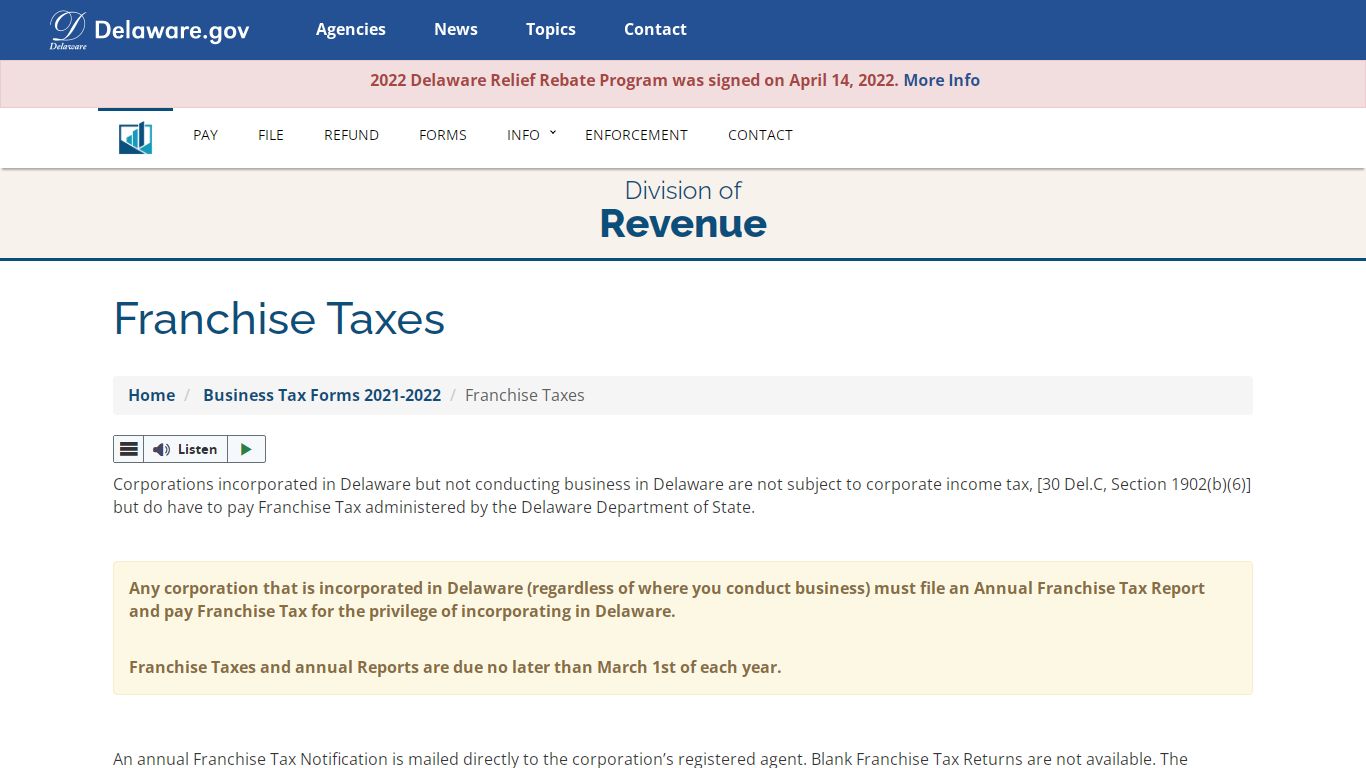

Franchise Taxes - Division of Revenue - State of Delaware

Corporations incorporated in Delaware but not conducting business in Delaware are not subject to corporate income tax, [30 Del.C, Section 1902(b)(6)] but do have to pay Franchise Tax administered by the Delaware Department of State. ... By email: [email protected]. or. The Delaware Department of State Division of Corporations PO Box 898, Dover ...

https://revenue.delaware.gov/business-tax-forms/franchise-taxes/

Delaware Corporate Law - State of Delaware

Why Incorporate in Delaware? More than one million business entities take advantage of Delaware's complete package of incorporation services, including modern and flexible corporate laws, our highly-respected Judiciary and legal community, a business-friendly government, and the customer-service-oriented staff of the Division of Corporations.

http://corplaw.delaware.gov/